Many people dream of owning a vacation home in Florida, and for good reason. The Sunshine State boasts beautiful beaches, warm weather, and plenty of attractions. However, owning a vacation home or Airbnb property comes with its own set of challenges, including maintenance, management and taxes. As the housing market shifts, owners may wonder if now is a good time to sell their Florida vacation home or Airbnb property.

The answer to whether now is a good time to sell a Florida vacation home or Airbnb property depends on several factors. One of the most important factors is the current state of the housing market. If the market is strong, owners may be able to sell their property for a higher price. Additionally, if the owner has had the property for several years, they may have built up equity, which can also make it a good time to sell. However, if the market is weak or the owner has not owned the property for very long, it may not be the best time to sell.

Understanding the Current Real Estate Market in Florida

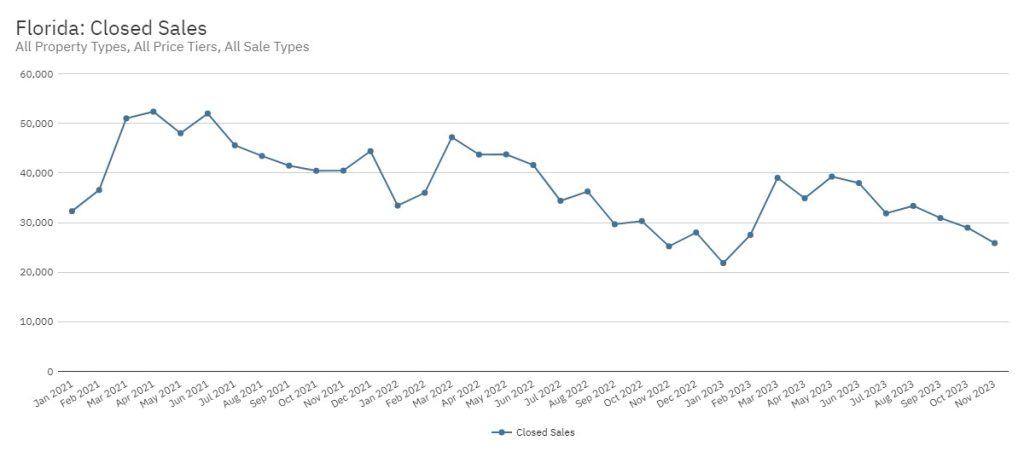

Market Trends

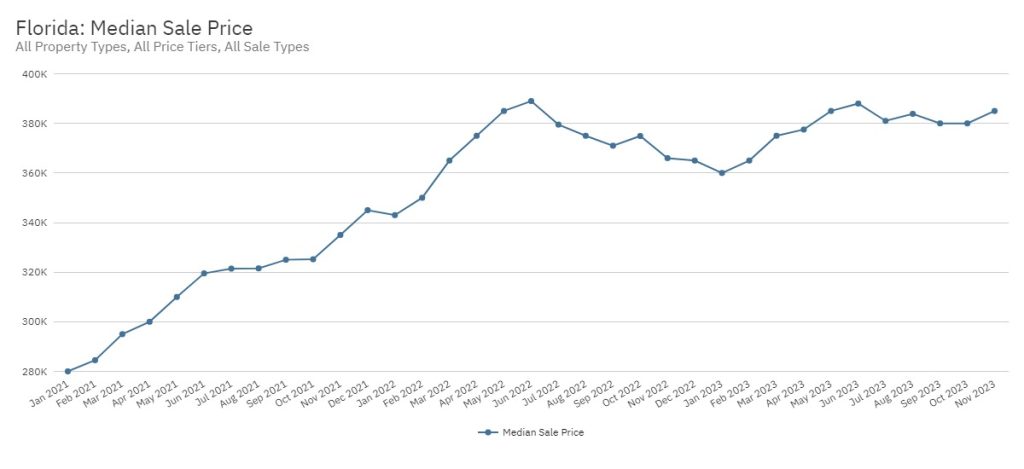

The Florida real estate market has seen a lot of ups and downs in the past few years. According to recent data from Florida Realtors, the sales of existing single-family homes in Florida decreased by 7.9% year-over-year, while existing condo-townhouse sales decreased by 7.2% from August 2022. However, rising home sale prices in 2021 and 2022 are promising signs that 2023 / 2024 could be profitable for sellers.

As of July 2023, the national average price increase was around 3.4% year-over-year, while Fannie Mae expects a 3.5% to 3.9% price rise by year-end. On the other hand, Freddie Mac has a more conservative prediction of a 0.8% increase over the next 12 months.

Demand and Supply

The demand for Florida real estate has always been high due to the state’s warm climate, beautiful beaches, and favorable tax environment. However, the supply of homes for sale has been decreasing, leading to a tight housing market. As of August 2023, the median home sale price in Florida was up 3.7% compared to July 2023, and home sales rose 7.4% despite the low inventory and alarming mortgage rates.

The low inventory of homes for sale has been a significant factor in the current real estate market in Florida. As of August 2023, the number of homes sold above listing price increased by 16.2 points year-over-year. However, homes in Florida are also taking longer to sell, with an average of 49 days on the market, up from 24 days from last year.

Overall, the current real estate market in Florida is experiencing a tight housing market due to the low inventory of homes for sale. However, rising home sale prices and favorable tax environment make it a good time to sell a Florida vacation home or Airbnb property.

Assessing Your Property’s Value

When considering selling a Florida vacation home or Airbnb property, it is important to assess its value accurately. This will help ensure that the property is priced correctly and that the seller gets the best possible return on their investment. Here are two key factors to consider when assessing the value of a vacation home or Airbnb property:

Property Valuation

A property valuation is an independent assessment of a property’s value by a licensed appraiser or experienced real estate professional. They will consider various factors, including the property’s location, size, condition, and recent sales of comparable properties in the area, providing a report detailing their findings and an estimated value for the property.

Getting a property valuation can be a useful tool for determining the value of a vacation home or Airbnb property. It should be noted, however, that appraisals can be costly with fees ranging from a few hundred to several thousand dollars. Additionally, an appraisal may not take into account the unique features or potential income streams of an Airbnb property, which can impact its value.

Rental Income Analysis

For Airbnb properties, a rental income analysis can be a useful tool for assessing its value. This involves analyzing the property’s rental income and occupancy rates over a period of time, typically the past 12 months. This data can provide valuable insights into the property’s earning potential and help determine its value.

When conducting a rental income analysis, it is important to consider factors such as seasonality, competition in the area, and any upcoming events or attractions that may impact demand. It is also important to ensure that the data used in the analysis is accurate and up-to-date.

Overall, assessing the value of a Florida vacation home or Airbnb property requires careful consideration of various factors. By taking the time to conduct a thorough analysis, sellers can ensure that their property is priced correctly and that they get the best possible return on their investment.

Tax Implications of Selling Your Property

When considering selling a vacation home or Airbnb property in Florida, it is important to understand the tax implications of the sale. Here are two key tax considerations to keep in mind:

Capital Gains Tax

One major tax implication of selling a property is capital gains tax. This tax is levied on the profit made from the sale of an asset, such as a vacation home or rental property. In Florida, there is no state capital gains tax, but sellers may still be subject to federal capital gains tax.

The amount of capital gains tax owed depends on several factors, including how long the property has been owned and the seller’s income level. If the property has been owned for more than a year, the seller may qualify for a lower long-term capital gains tax rate. However, if the property has been owned for less than a year, the seller may be subject to a higher short-term capital gains tax rate.

Be sure to check with a tax professional to find out the implications for your property.

Depreciation Recapture

Another tax consideration when selling a rental property is depreciation recapture. This tax applies to the portion of the property’s value that was depreciated over the years it was owned. Essentially, the IRS wants to recapture the tax benefits that the seller received for depreciating the property over time.

Depreciation recapture is taxed at a higher rate than capital gains tax, so it is important for sellers to factor this into their calculations when determining the potential profit from selling the property. However, there are ways to minimize depreciation recapture tax, such as conducting a 1031 exchange or structuring the sale as an installment sale.

Overall, sellers should consult with a tax professional to fully understand the tax implications of selling their vacation home or Airbnb property in Florida. By doing so, they can make informed decisions about whether now is a good time to sell and how to maximize their profits while minimizing their tax liability.

Considerations for Airbnb Properties

Airbnb Regulations in Florida

When considering selling an Airbnb property in Florida, it is important to be aware of the state’s regulations on short-term rentals. Florida has passed a law that prohibits local governments from regulating vacation rentals based on their frequency or duration of occupancy. However, this law does allow local governments to regulate vacation rentals in other ways, such as noise ordinances and zoning restrictions.

It is important to research the specific regulations in the area where the Airbnb property is located to ensure compliance with all local laws. This can include obtaining necessary permits and licenses, collecting and remitting taxes, and adhering to safety and health regulations.

Impact of Tourism

Florida is a popular tourist destination, with many visitors choosing to stay in short-term rental properties like Airbnb. The state’s tourism industry can have a significant impact on the demand and profitability of Airbnb properties.

When considering selling an Airbnb property in Florida, it is important to research the current state of the tourism industry in the area where the property is located. Factors to consider include the number of visitors to the area, the popularity of short-term rentals, and the availability of alternative accommodations like hotels and resorts.

Additionally, it is important to consider the potential impact of external factors like natural disasters or economic downturns on the tourism industry and, in turn, the demand for Airbnb properties.

Timing Your Sale

When it comes to selling a vacation home or Airbnb property in Florida, timing can be crucial. Understanding seasonal factors and economic indicators can help sellers make informed decisions about when to list their property.

Seasonal Factors

Florida’s peak tourist season typically runs from December to April, when the weather is mild and pleasant. During this time, demand for vacation homes and Airbnb properties tends to be high, which can lead to faster sales and higher prices.

On the other hand, the summer months and hurricane season (June to November) can be less favorable for sellers. Many tourists and snowbirds leave the state during this time, leading to a decrease in demand. Additionally, the risk of hurricanes can make buyers hesitant to invest in a property.

Economic Indicators

Economic indicators can also play a role in determining the best time to sell a vacation home or Airbnb property in Florida. For example, low mortgage rates can make it easier for buyers to afford a property, leading to increased demand and higher prices.

Similarly, a strong job market and overall economic growth can also contribute to a favorable selling environment. When people feel confident about their job security and financial situation, they may be more likely to invest in a second home or vacation property.

Overall, sellers should carefully consider both seasonal factors and economic indicators when deciding when to list their vacation home or Airbnb property in Florida. By doing so, they can increase their chances of a successful sale and maximize their profits.

Should You Sell Now?

After analyzing the current real estate market and considering the factors that could affect the value of a vacation home or Airbnb property in Florida, it is difficult to give a definitive answer to the question of whether now is a good time to sell.

On one hand, the demand for vacation homes and short-term rentals has increased significantly in recent years, and this trend is expected to continue in the foreseeable future. This means that owners of vacation homes and Airbnb properties in Florida may be able to sell their properties at a premium price, especially if they have a good location and a strong rental history.

On the other hand, there are also some factors that could negatively impact the value of a vacation home or Airbnb property in Florida, such as changes in tax laws, economic downturns, and natural disasters. It is important for owners to consider these risks before making a decision to sell.

Ultimately, the decision to sell a vacation home or Airbnb property in Florida should depend on the owner’s personal circumstances, financial goals, and risk tolerance. It may be a good idea to consult with a real estate agent or financial advisor to get a better understanding of the current market conditions and the potential risks and benefits of selling.

Are You Ready to Sell Your Second Home or Vacation Property?

To help our followers with the sale of their Florida vacation property or Airbnb / VRBO investment, Endless Summer has affiliated with Quantum Realty Advisors, Inc. (“Quantum”) which is a licensed Florida real estate company that has been in business since 1998. Quantum has successfully assisted buyers & sellers of properties on hundreds of transactions throughout the State of Florida as well as in a number of major markets throughout the United States.

From less than $500,000 to more than $5 million, the Quantum team will be happy to assist with the sale process and can be reached at 561.584.8555

Quantum Realty Advisors, Inc.

4440 PGA Boulevard, Suite 308 | Palm Beach Gardens, FL 33410

561.584.8555

Quantum’s experienced real estate advisors will take the time to discuss exactly what your are looking for in a vacation home as well your what will fit into you budget. And when you are ready to begin, they will be with you every step of the way. Click here to learn more about Quantum.