Are Vacation Homes in Florida a Good Investment? Pros and Cons to Consider

Investing in a vacation home in Florida can be an exciting prospect for many people. With its sunny weather, beautiful beaches, and abundance of attractions, Florida is a popular vacation destination for people from all over the world. But is buying a vacation home in Florida a good investment?

The answer to this question depends on a number of factors, including the location of the property, the current state of the real estate market, and the goals of the investor. While some people may be looking for a property that they can use as a second home for themselves and their families, others may be more interested in buying a property that they can rent out to vacationers and earn a steady stream of income.

In this article, we will explore the pros and cons of investing in a vacation home in Florida. We will look at some of the most popular areas for vacation homes in the state, as well as the potential risks and rewards of owning a property in this market. Whether you are a seasoned real estate investor or a first-time buyer, this article will provide you with the information you need to make an informed decision about whether a vacation home in Florida is the right investment for you.

Why Invest in Vacation Homes?

Investing in vacation homes in Florida can be a great opportunity for those looking to diversify their investment portfolio. Here are a few reasons why:

- Potential for rental income: Vacation homes can generate rental income when not in use by the owner. Florida is a popular tourist destination, which means there is a high demand for vacation rentals. This can provide a steady stream of income for owners.

- Appreciation in value: Real estate in Florida has historically appreciated in value over time. This means that your vacation home could be worth more in the future than what you paid for it.

- Tax benefits: Vacation homes can provide tax benefits for owners. For example, owners can deduct mortgage interest, property taxes, and other expenses associated with owning the property.

- Personal use: Owning a vacation home in Florida can provide a place for owners to escape to during the winter months or for family vacations. This can be a great way to enjoy the property while also generating rental income.

- Diversification: Investing in vacation homes can provide diversification to an investment portfolio. Real estate can behave differently than other asset classes, which can help reduce risk.

Overall, investing in vacation homes in Florida can be a good opportunity for those looking to generate rental income, diversify their investment portfolio, and potentially benefit from appreciation in value over time.

Florida’s Real Estate Market

Market Overview

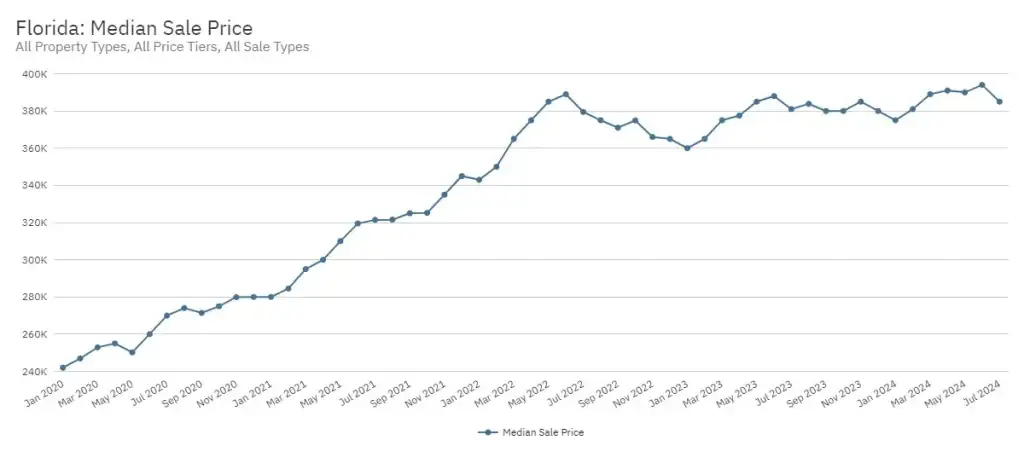

Florida’s real estate market has been one of the most profitable in the US for years. The state’s warm climate and beautiful beaches make it a popular destination for vacationers and retirees, which drives demand for vacation homes. As of 2023, the market remains strong, but it’s important to note that it’s not immune to fluctuations.

Trends and Predictions

Vacation home demand in Florida has decreased close to a seven-year low, with a 19% decline year-to-year, according to Florida Realtors. This decline may be due to the pandemic’s impact on travel and tourism. However, it’s important to note that the pandemic also caused a surge in vacation home mortgage locks.

Despite the recent decline in demand, Florida’s real estate market is predicted to remain strong in the long term. HomeLight lists eight of the hottest markets for Florida real estate investment, including Miami, Orlando, and Tampa. These markets are expected to continue to grow due to the state’s population growth and strong economy.

Overall, Florida’s real estate market is a good option for those looking to invest in vacation homes. However, it’s important to do thorough research and keep an eye on market trends to make informed investment decisions.

Click here to learn more about the Florida housing market.

Benefits of Investing in Florida Vacation Homes

Florida is a popular vacation destination, attracting millions of visitors each year. As a result, vacation homes in Florida can be a lucrative investment opportunity. Here are some benefits of investing in Florida vacation homes:

Rental Returns

Florida’s tourism industry is thriving, making it an attractive location for vacation home rentals. According to Mashvisor, the average rental income for a vacation home in Florida is $3,500 per month. With such high rental revenues, investors can potentially earn a significant return on their investment.

Tax Advantages

Florida has several tax advantages that make it an appealing location for vacation home investment. For example, Florida does not have a state income tax, which can be a significant benefit for investors. Additionally, Florida has relatively low property taxes compared to other states, which can result in significant savings for investors.

Property Appreciation

Florida’s real estate market has historically shown strong appreciation rates, making it an attractive location for real estate investment. As a result, investing in a vacation home in Florida can potentially provide both short-term rental income and long-term appreciation.

Purchasing a vacation home in Florida can be a smart financial decision for those looking to diversify their investment portfolio. With high rental yields, tax advantages, and strong property appreciation rates, Florida vacation homes can provide both short-term rental income and long-term appreciation potential.

Potential Risks and Challenges

When considering investing in a vacation home in Florida, it is important to be aware of potential risks and challenges. Here are a few key factors to keep in mind:

Property Management

If the vacation home is not going to be used as a primary residence, property management can be a significant challenge. Finding reliable property managers who can handle maintenance, repairs, and rental management can be difficult. It is important to do thorough research and vet potential property management companies before making a decision.

Seasonal Fluctuations

Florida’s tourism industry is heavily influenced by seasonal fluctuations. During the peak winter months, vacation homes can be in high demand and command high rental rates. However, during the off-season, it may be difficult to find renters. This can result in lower rental income and higher vacancy rates. It is important to consider these fluctuations when calculating potential returns on investment.

Insurance Costs

Florida is known for its extreme weather conditions, including hurricanes and flooding. As a result, insurance costs for vacation homes can be higher than in other areas. It is important to factor in these added costs when budgeting for a vacation home investment.

Overall, investing in a vacation home in Florida can be a smart financial decision, but it is important to be aware of potential risks and challenges. By doing thorough research, carefully considering all factors, and working with experienced professionals, investors can mitigate these risks and maximize their returns.

Choosing the Right Location

When it comes to investing in a vacation home in Florida, choosing the right location is crucial. Here are some factors to consider:

Popular Tourist Destinations

Florida is home to several popular tourist destinations that attract visitors from all over the world. These destinations include Orlando and Miami. While investing in a vacation home in one of these areas can be expensive, it can also be very profitable due to the high demand for rental properties.

Orlando, for example, is home to several theme parks, including Walt Disney World and Universal Orlando. These parks attract millions of visitors each year, making it an ideal location for a vacation home investment. Miami, on the other hand, is known for its beautiful beaches, vibrant nightlife, and cultural attractions. Investing in a vacation home in Miami can be a great way to tap into the city’s thriving tourism industry.

Emerging Markets

While popular tourist destinations can be lucrative, investing in emerging markets can also be a smart move. These markets are areas that are experiencing growth and development, making them attractive to both tourists and investors.

One emerging market to consider is Clearwater, which is located in the Tampa Bay area. Clearwater’s sunny weather and beautiful gulf beaches make it a popular destination for tourists. Another emerging market is Navarre, which is located on the Gulf of Mexico. Navarre’s stunning beaches and smaller short-term rental market make it a great location for a vacation home investment.

Overall, when choosing a location for a vacation home investment in Florida, it is important to consider factors such as demand, growth potential, and rental income potential. By carefully researching and choosing the right location, investors can maximize their returns and build a successful vacation home rental business.

Financial Considerations

When considering purchasing a vacation home in Florida, there are several financial considerations that should be taken into account. This section will cover some of the most important factors to consider when making this investment.

Financing Options

There are several financing options available for those looking to purchase a vacation home in Florida. Some of the most common options include a conventional mortgage, a home equity loan, or a cash purchase.

A conventional mortgage is a popular choice for many buyers. This type of loan typically requires a down payment of 20% or more and has a fixed interest rate. A home equity loan, on the other hand, allows homeowners to borrow against the equity they have built up in their primary residence. This type of loan can be used to purchase a second home, but it typically has a higher interest rate than a conventional mortgage.

Finally, a cash purchase is an option for those who have the funds available to purchase a vacation home outright. While this option eliminates the need for a mortgage, it may not be feasible for all buyers.

Return on Investment

When considering purchasing a vacation home in Florida, it is important to evaluate the potential return on investment. While owning a vacation home can provide a source of rental income, it is important to understand that there are also ongoing expenses associated with owning and maintaining a second property.

Some of the ongoing costs to consider include property taxes, insurance, maintenance, and management fees. It is important to factor these expenses into your overall budget when evaluating the potential return on investment.

In addition to rental income, there are other potential benefits to owning a vacation home in Florida. For example, owning a second home in a desirable location can provide a place for you and your family to enjoy vacations and create lasting memories.

Overall, purchasing a vacation home in Florida can be a good investment for those who are able to properly evaluate the potential return on investment and manage the ongoing expenses associated with owning a second property.

Finalizing Your Decision

Owning a vacation home in Florida can be a lucrative investment for those who are willing to put in the effort to manage and maintain the property. The state’s warm climate, beautiful beaches, and numerous attractions make it a popular destination for tourists and visitors year-round.

While there are certainly risks involved, such as the potential for natural disasters and fluctuations in the real estate market, the pros of owning a vacation home in Florida outweigh the cons for many investors. Some of the key advantages include:

- A reliable source of rental income, especially during peak tourist season

- The potential for long-term appreciation in property value

- The ability to use the property for personal vacations and getaways

- Tax benefits, such as deductions for mortgage interest and property taxes

Of course, it’s important to carefully consider the costs and responsibilities of owning a vacation home before making a purchase. Investors should factor in expenses such as property management fees, maintenance and repairs, insurance, and taxes when calculating potential profits.

Overall, investing in a vacation home in Florida can be a wise decision for those who are willing to do their research and make informed choices. With the right strategy and management, a vacation home can provide a steady stream of income and a valuable asset for years to come.

Getting Started

To help our audience with buying or selling a home in Florida, Endless Summer has affiliated with Quantum Realty Advisors, Inc. (“Quantum”) which is a licensed Florida real estate company that has been in business since 1998.

From less than $500,000 to more than $5 million, the Quantum team will be happy to assist with your vacation home buying process. Quantum’s experienced real estate advisors will take the time to discuss exactly what your are looking for in a vacation home as well your what will fit into you budget.

When you are ready to begin, they will be with you every step of the way. Click here to contact the team at Quantum.