Housing Cost of Living in Florida: Key Factors Affecting Affordability in the Sunshine State

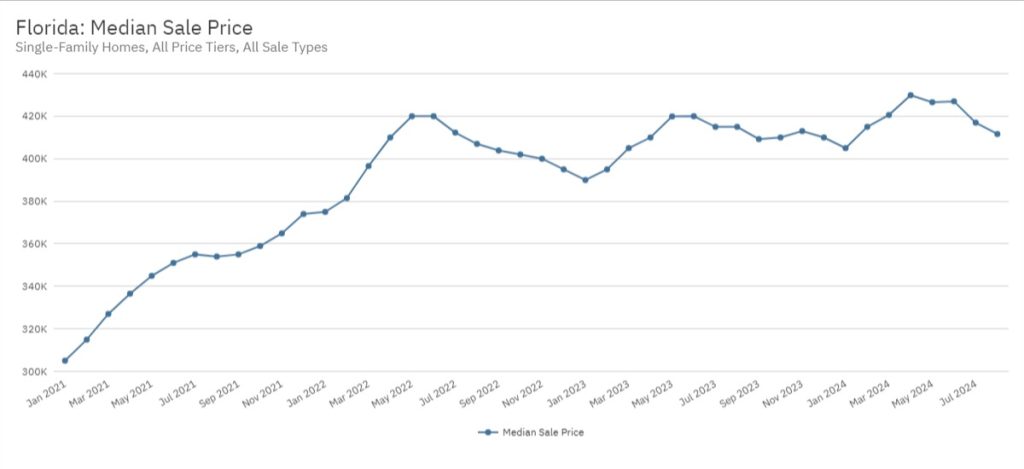

Florida’s cost of living presents a mixed picture for residents and potential newcomers. While the state offers no income tax and relatively affordable prices compared to some other popular U.S. destinations, housing costs can be a significant factor in overall expenses. The median sale price for a single-family home in Florida exceeded $410,000 as of August 2024, with prices in desirable areas like Miami climbing even higher to $650,000.

Rental markets across Florida’s major cities also reflect this trend. In Tampa, a one-bedroom apartment exceeds $1,400 per month, while Miami commands over $1,600 for similar accommodations. Orlando falls between these two, with one-bedroom units typically costing around $1,350 monthly. These figures underscore the importance of carefully considering location when budgeting for housing in the Sunshine State.

Despite higher housing costs, Florida’s overall cost of living ranks 32nd lowest in the country. This ranking takes into account factors beyond housing, such as the lack of state income tax and other living expenses. For those considering a move to Florida, it’s crucial to weigh these various elements against potential income and lifestyle preferences to determine if the state aligns with their financial goals.

Understanding the Cost of Living

Florida’s cost of living varies across the state, influenced by factors like housing, utilities, and food prices. The state’s living wage and cost of living index provide insights into expenses residents face.

Cost of Living Index

Florida’s cost of living index sits slightly above the national average. Housing costs contribute significantly to this index, with median home prices around $410,000 as of August 2024. Utility expenses also impact the overall cost, averaging around $150 per month.

Rent prices fluctuate based on location, ranging from $900 to $2,000 for a one-bedroom apartment. Urban areas like Miami tend to have higher costs, with single-family homes averaging $650,000.

The total annual cost of living in Florida ranks 21st out of 50 states, at approximately $40,512 per person. This figure includes housing, food, healthcare, transportation, and taxes.

Florida’s Living Wage

The living wage in Florida varies depending on family size and location. For a single adult, it’s typically higher than the state’s minimum wage.

Florida’s average annual salary is $55,833, which may or may not meet living wage requirements depending on individual circumstances. In some areas, housing costs exceed 30% of household income, particularly for renters.

The federal government considers housing affordable if it costs less than 30% of income. However, about half of Tampa Bay renters exceed this threshold.

To maintain a comfortable standard of living, Florida residents often need to earn more than the state’s average salary, especially in high-cost urban areas.

Housing Expenses

Florida’s housing market presents diverse options for residents. The state’s real estate landscape offers both opportunities and challenges, with costs varying significantly across different regions.

Buying vs. Renting

In Florida, the decision to buy or rent depends on location and financial goals. As of 2024, the median home price in Florida stands at $485,000, slightly above the national average. Major cities like Miami and Orlando tend to have higher prices, while smaller towns offer more affordable options. Renting can be a viable alternative, with average monthly rates for a one-bedroom apartment ranging from $1,200 to $2,000 depending on the area.

Coastal properties often command premium prices due to their desirable locations. First-time homebuyers may find more affordable options inland or in developing communities. Property taxes in Florida are relatively moderate compared to other states, which can be a factor in long-term housing costs.

Utility Costs in Florida

Florida’s utility expenses can impact overall housing costs significantly. The state’s warm climate leads to higher electricity usage for air conditioning, especially during summer months. On average, Florida residents pay about $130-$150 per month for electricity.

Water bills in Florida typically range from $30 to $70 monthly. Natural gas is less common in Florida homes, but where used, costs average $30-$50 per month. Internet and cable services usually add another $50-$100 to monthly expenses.

Energy-efficient homes and appliances can help reduce utility costs. Some areas offer solar energy options, which may lead to long-term savings despite initial installation expenses.

Food and Grocery Costs

Florida’s food and grocery costs contribute significantly to the overall cost of living in the state. The average monthly grocery expenses for a single person in Florida amount to $323.83.

This figure places Florida slightly above the national average for food costs. Factors influencing these expenses include the state’s reliance on imported produce and the impact of tourism on local food prices.

Coastal areas and popular tourist destinations tend to have higher food costs compared to inland regions. Fresh seafood is readily available but can be pricier due to high demand.

Grocery shopping strategies can help manage costs:

- Buying seasonal produce

- Shopping at farmers markets

- Taking advantage of store loyalty programs

Major grocery chains in Florida include Publix, Winn-Dixie, and Walmart. These stores often compete on prices, benefiting consumers through sales and promotions.

Restaurant dining in Florida varies widely in cost. Casual eateries and fast-food options are generally affordable, while upscale restaurants in tourist areas can be quite expensive.

Transportation Expenditures

Transportation costs in Florida vary depending on location and lifestyle choices. Residents have options ranging from public transit systems to personal vehicles.

Public Transportation

Florida’s major cities offer public transportation networks. Miami-Dade County operates an extensive system including buses, metro rail, and a free downtown trolley. Monthly passes cost around $112.50 for unlimited rides.

Orlando’s LYNX bus system covers a wide area, with day passes priced at $4.50. Jacksonville’s JTA buses and skyway provide affordable options, with single rides at $1.50.

Tampa’s HART system offers buses and a streetcar line. Monthly passes run about $65.

Vehicle Costs

Owning a car in Florida comes with various expenses. The average annual cost of car ownership is approximately $8,500, including fuel, insurance, maintenance, and depreciation.

Florida’s gas prices tend to be lower than the national average. As of October 2024, the state average is $3.15 per gallon.

Auto insurance rates in Florida are higher than the national average. Drivers pay around $2,560 annually for full coverage insurance.

Vehicle registration fees vary by weight, with most passenger vehicles costing $225 for initial registration and $14.50 to $32.50 for renewals.

Healthcare and Insurance

Florida’s healthcare system and insurance landscape play crucial roles in residents’ overall cost of living. The state offers diverse healthcare options and insurance plans, impacting both quality of care and financial considerations.

Health Insurance in Florida

Florida’s health insurance market includes various options for residents. The state participates in the federal Health Insurance Marketplace, offering plans during annual open enrollment periods. Many Floridians obtain coverage through employer-sponsored plans, while others opt for individual policies.

Premiums vary based on factors like age, location, and plan type. In 2024, the average monthly premium for a Silver plan on the Marketplace is approximately $450 for a 40-year-old individual. Low-income residents may qualify for subsidies to reduce costs.

Florida has not expanded Medicaid under the Affordable Care Act, limiting eligibility for this program to specific groups like low-income families, pregnant women, and elderly individuals.

Florida Healthcare System

Florida boasts a robust healthcare infrastructure with numerous hospitals, clinics, and specialized medical centers. Major cities like Miami, Orlando, and Tampa house world-renowned medical facilities attracting patients from across the globe.

The state faces challenges in rural healthcare access, with some areas experiencing shortages of primary care physicians and specialists. Telemedicine services have grown to address this gap, particularly in remote regions.

Florida’s warm climate attracts retirees, influencing the healthcare landscape. Many facilities specialize in geriatric care and age-related conditions. The state also emphasizes preventive care and wellness programs to manage healthcare costs.

Healthcare costs in Florida generally align with national averages, though prices can vary significantly between urban and rural areas. Out-of-pocket expenses depend on insurance coverage and the specific medical services required.

Taxes in Florida

Florida’s tax structure offers some advantages to residents. The state has no personal income tax and relatively low property taxes compared to many other states. However, sales taxes can be higher in certain areas.

Sales Tax

Florida imposes a 6% state sales tax on most goods and services. Counties can add their own local sales taxes, bringing the total up to 8.5% in some areas. Food, prescription drugs, and certain medical supplies are exempt from sales tax.

Tourist areas often have higher local sales tax rates. For example, Orlando’s combined rate is 6.5%. Large purchases like cars or boats are subject to sales tax based on the county where the item will be registered.

Clothing and shoes under $100 are tax-free during Florida’s annual back-to-school sales tax holiday.

Property Tax

Property taxes in Florida are assessed at the county level. The average effective property tax rate is about 0.97%, lower than the national average of 1.07%. Rates vary significantly by county and municipality.

Florida offers a homestead exemption that can reduce the taxable value of a primary residence by up to $50,000. Additional exemptions are available for seniors, veterans, and disabled residents.

Property taxes are calculated using millage rates. One mill equals $1 in tax for every $1,000 of assessed property value. For a $300,000 home with a 5 mill rate, the annual property tax would be $1,500.

Income Tax

Florida is one of nine states with no personal income tax. This can result in significant savings for residents, especially those with higher incomes.

The lack of state income tax is partially offset by higher sales taxes and tourism-related fees. Florida relies heavily on sales tax revenue to fund state operations.

Businesses in Florida are subject to a 5.5% corporate income tax on earnings over $50,000. Some corporations may qualify for exemptions or credits.

Retirees often find Florida’s tax structure appealing, as Social Security benefits, pension income, and IRA distributions are not taxed at the state level.

The Process of Moving to Florida

Relocating to Florida involves careful planning and consideration of various costs. Understanding the financial aspects of the move and adjusting to local living expenses are crucial steps in ensuring a smooth transition.

Relocation Costs

Moving to Florida can be expensive, with costs varying based on distance and volume of belongings. Long-distance moves typically range from $2,000 to $5,000 or more. Hiring professional movers offers convenience but adds to expenses.

DIY moves using rental trucks can be more budget-friendly. Fuel, lodging, and food costs during the journey should be factored in. Shipping vehicles separately may be necessary, costing $500 to $1,500 per car.

Initial setup costs in Florida include utility deposits, new furniture purchases, and potential home repairs or renovations. Setting aside an emergency fund for unexpected expenses is advisable.

Adjusting to Local Living Costs

Florida’s cost of living varies by region. Miami and other coastal areas tend to be pricier than inland locations. Housing costs are a significant factor, with median home prices ranging from $475,000 in Tampa to $650,000 in Miami.

Renters should budget for higher deposits and monthly rates in popular areas. Utility costs can be substantial due to year-round air conditioning use. Grocery expenses may differ from other states, with some items costing more due to transportation.

Insurance costs, particularly for homeowners and vehicles, can be higher in Florida due to hurricane risks. Factoring in these local expenses is crucial for creating an accurate budget and ensuring financial stability after the move.

Using Cost of Living Calculators

Cost of living calculators are valuable tools for comparing expenses between different locations. These calculators take into account various factors such as housing, food, transportation, and utilities to provide a comprehensive comparison.

Many websites offer free cost of living calculators. Popular options include Salary.com, NerdWallet, and SmartAsset. These tools allow users to input their current location, salary, and desired destination to see how their expenses might change.

When using a cost of living calculator, it’s important to consider specific categories that may be most relevant to your situation. For example, if you have a family, you might want to focus on housing costs and education expenses.

Some calculators provide more detailed breakdowns than others. Salary.com’s calculator, for instance, offers information on minimum wage rates in different locations. This can be particularly useful for those considering a move to Florida, where the minimum wage is set to be $13 per hour in 2024.

It’s worth noting that these calculators provide estimates based on average data. Your actual expenses may vary depending on your lifestyle and specific circumstances. Using multiple calculators can help you get a more well-rounded picture of potential costs.

Are you interested in owning a home in Florida?

If the allure of sun-kissed beaches, vibrant communities, and year-round warmth speaks to your heart, owning a home in Florida might just be your next great adventure!

To help our audience with buying or selling a home in Florida, Endless Summer has affiliated with Quantum Realty Advisors, Inc. (“Quantum”) which is a licensed Florida real estate company that has been in business since 1998. Quantum’s experienced real estate advisors will take the time to discuss exactly what your are looking for in a home as well your what will fit into you budget.

When you are ready to begin, they will be with you every step of the way. Click here to contact the team at Quantum.